INDUSTRY EXPERTISE

State and Local Government

HORNE maximizes reimbursements, expedites recovery, preserves trust and prevents fraud and deobligation on federally funded programs.

Featured insights:

HORNE’s field-tested team guides and assists state and local governments as they design and implement programs to build prosperous and resilient communities.

Our subject-matter experts provide guidance on grant compliance and policy leadership, earning us best-practice recognition reports from regulatory agencies.

“We give you options, thoughts and solutions that help you accelerate your recovery and ensure your compliance to the end. That’s what differentiates HORNE. That’s why we are repeatedly rehired across the country.”

– Jonathan Krebs, Managing Partner

Solutions to help government agencies create positive change.

Program Management

We make sure programs are effective, efficient and compliant from inception to closeout.

Disaster Recovery

When disasters strike, the most vulnerable suffer. Our mission is to help those citizens recover faster.

Compliance

Our team applies financial acumen, government experience and knowledge to ensure program compliance and prevent fund deobligation.

Speed and Compliance Ensure Homeowner Assistance Fund Program Success

With deadlines approaching, states must execute quickly and manage funds responsibly. With a long history of service in crisis situations, we can speed processes to deliver results and ensure your program is compliant.

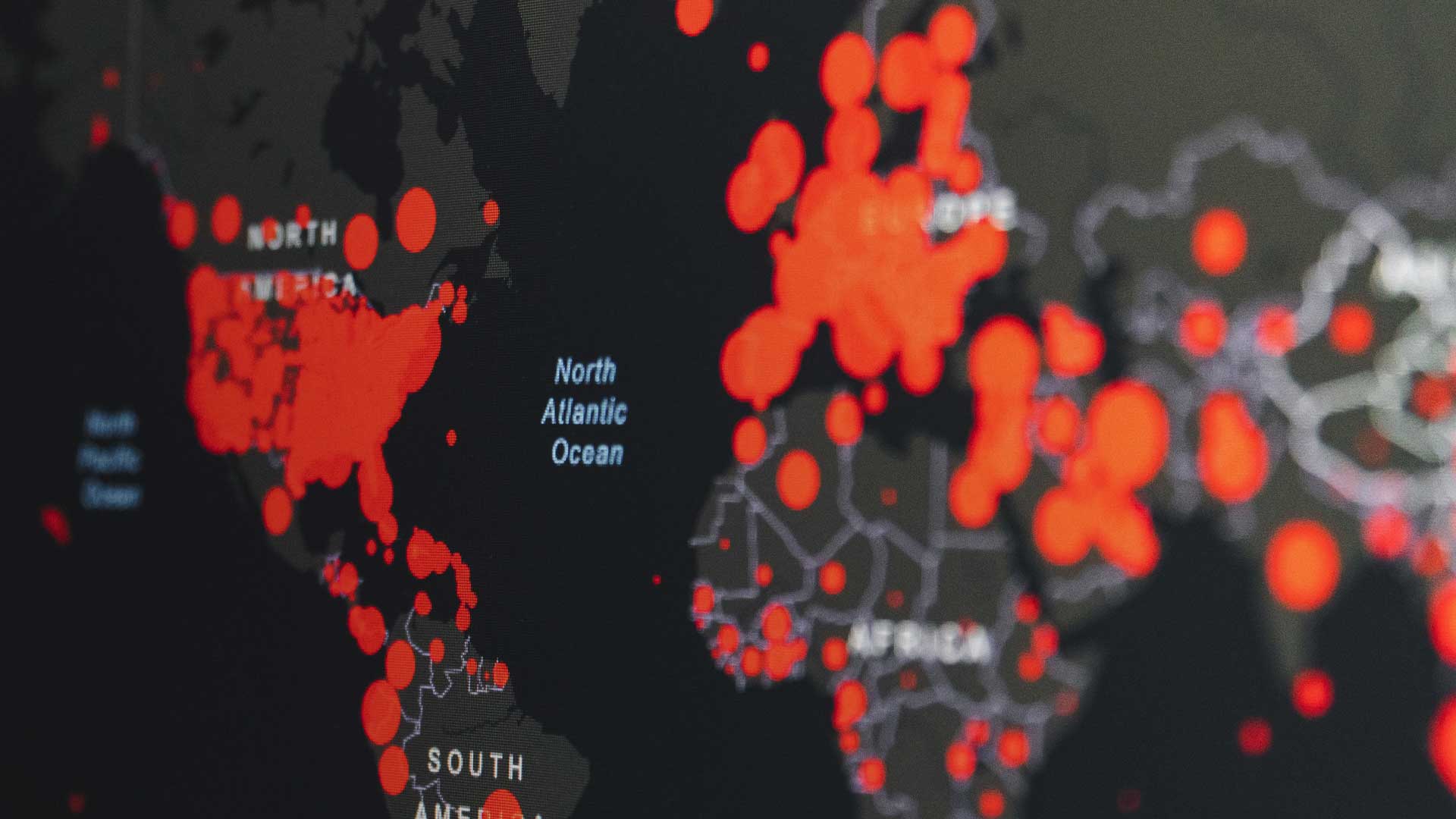

COVID-19 Response

Our proven methods are helping local governments, state agencies and healthcare systems deliver aid quickly while maintaining compliance.